Crypto's derivatives market has a $86 trillion problem. Daily perp volume dwarfs spot, yet the instrument itself is fundamentally unsuited for anything beyond short-term speculation. Meanwhile, the infrastructure that makes every other asset class complete — volatility indices, insurance layers, convex payoffs — remains conspicuously absent.

While options were previously dismissed in crypto due to the latter's nascency, perhaps this is the cycle for them to emerge onchain.

Perps are flawed

Perpetual futures have become crypto's default leverage instrument by accident of history. They solve one problem well — simple, expiration-free leverage — but introduce two fatal flaws.

1. Path dependence = maximum pain.

Perps require continuous margin maintenance. A 50% drawdown liquidates 2x positions regardless of where price ends up afterward. You can be directionally correct and still lose everything because you couldn't survive the path. This makes perps atrocious — especially long-term — hedges.

2. Linearity is capital inefficient.

Consider a simple outcome. Bitcoin rallies from $100k to $150k over six months.

A 3x leveraged perp position using $33k of margin earns roughly $50k in profit assuming no liquidation — a ~150% return on capital.

The $120k call — let's say at $8k cost — settles at $30k intrinsic value. That's a ~$22k profit — nearly a 275% return on capital — with no liquidation risk.

A need for insurance

In equities, the VIX and VVIX provide real-time barometers of fear and tail risk. In rates markets, swaptions allow institutions to hedge duration exposure without unwinding positions.

Crypto has no equivalent. And the absence is felt most acutely by those who can't exit.

Validators or liquid stakers have ETH, SOL, etc. exposure with no efficient way to reduce delta without unstaking — defeating the purpose. A covered call strategy or protective put would let them monetize volatility or cap losses while maintaining staking rewards. Alternatively, a crypto VIX could insure future swings.

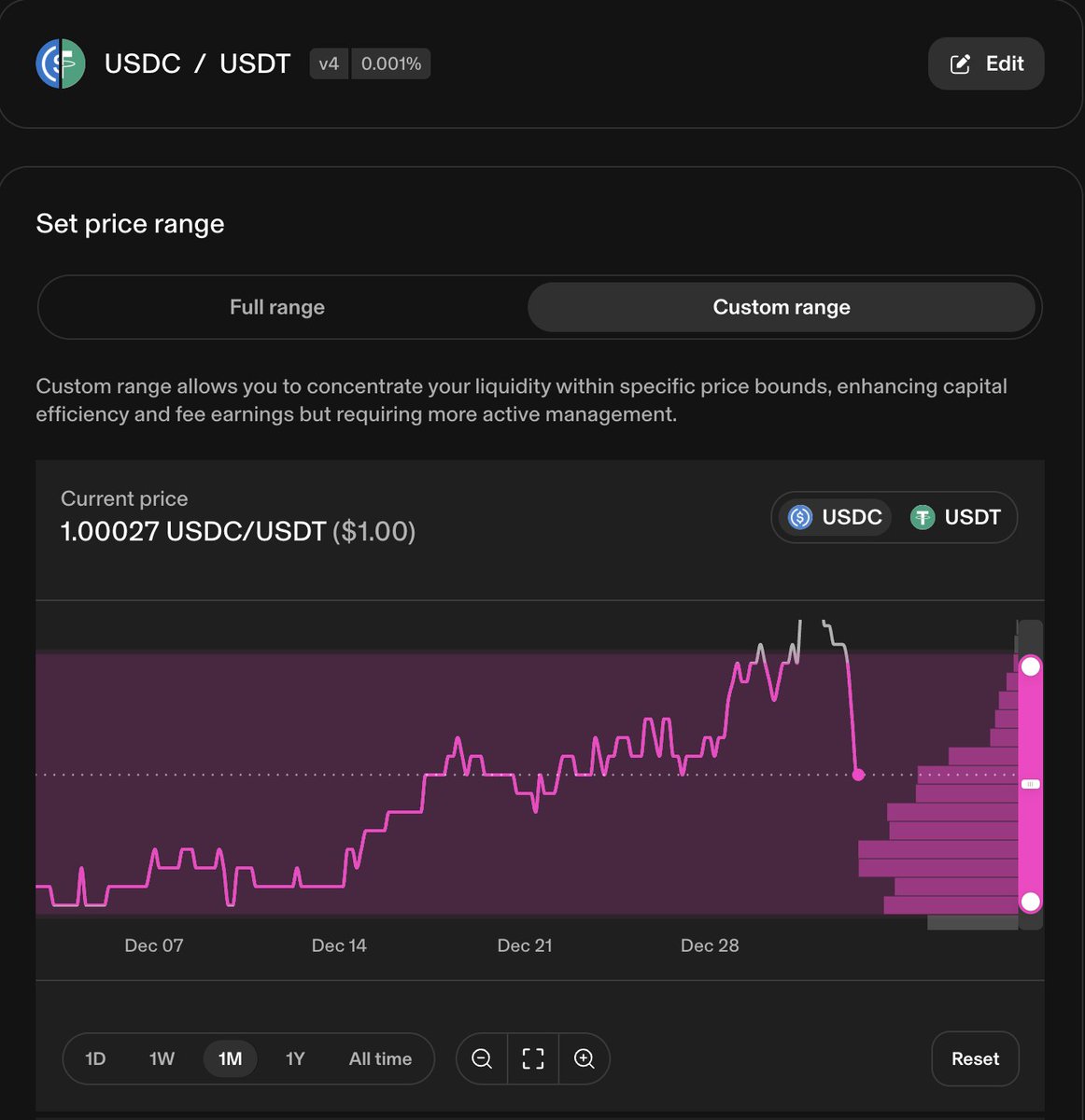

AMM LPs face impermanent loss that's purely path-dependent. Uniswap v3 concentrated liquidity positions are effectively short gamma — they lose money when volatility spikes. However, there's no way to purchase convexity to offset this. A straddle or variance swap would let LPs hedge their implicit short vol exposure.

Without options, vaults, LPs, and traders either accept unhedgeable risk or deploy capital-intensive workarounds (e.g., short perps that get liquidated in a squeeze).

Bitcoin's volatility compression

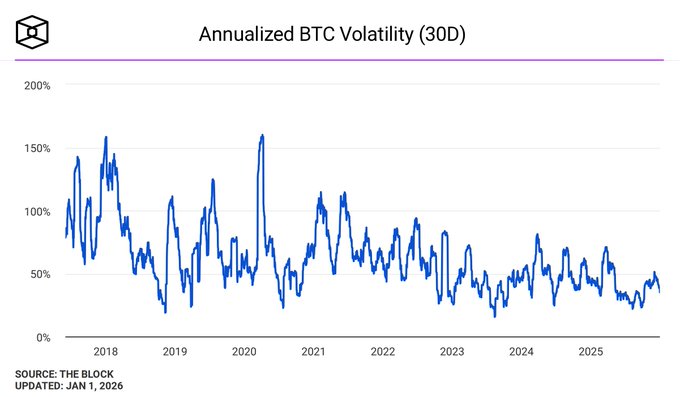

Since the 2018 cycle, Bitcoin's annualized volatility has persistently declined. Although cycles still harbor episodic spikes, the baseline has trended lower as liquidity deepened and market structure improved.

To contextualize: as of late December 2025, Bitcoin's 30-day historical volatility sat at approximately 45% annualized. Compare this to major equities with comparable or smaller market caps:

- Apple (AAPL): ~14% 30-day HV, $4.0T market cap

- Tesla (TSLA): ~39% 30-day HV, $1.5T market cap

- NVIDIA (NVDA): ~12% 30-day HV (using recent rolling data), $4.5T market cap

- S&P 500 (SPY): ~9% 30-day HV, representing $45T+ in aggregate market cap

- Bitcoin (BTC): ~45% 30-day HV, $1.8T market cap

Bitcoin now trades with volatility in line with Tesla — a $1.5 trillion company considered among the most volatile mega-caps. This indicates a radical shift from the 90-150% HV regime from 2017-2022.

Lower, more predictable volatility creates the foundational conditions for liquid options markets:

- Pricing stability: when realized vol compresses and stabilizes, implied vol surfaces become easier to calibrate. Market makers can warehouse vega risk without getting blown out by 50-point overnight moves.

- Longer-dated viability: 3-month and 6-month calls/puts become economically feasible. In a 150% vol regime, theta decay and gamma risk make long-dated contracts prohibitively expensive to hedge. At 45-60% vol, structured products like covered calls, collars, and put spreads become attractive.

- Variance risk premium: as vol stabilizes, the gap between implied and realized vol (the variance risk premium) becomes harvestable. Volatility sellers can profitably underwrite insurance when the underlying isn't prone to 20% overnight gaps.

Crypto's implicit options

In many ways, crypto has (not so secretly) been trading options for years.

A Polymarket binary contract priced at $0.10 for a 25bps FFR hike is functionally a call, entailing a deterministic resolution with an expiration date. Give prediction markets' recent proliferation, users comprehend path independence, expiration, and asymmetric payoffs. They're trading options; the interface just says "Yes" and "No". A recent paper by @DaedalusRsch formalized this equivalence, even proposing a mathematical model to standardize contract pricing.

Conclusion

Options — unironically — are not optional in capital markets. Every mature market runs on them because linear exposure is a liability. Crypto possesses the volume, the volatility profile, and now a user base that already comprehends binaries and expirations. Furthermore, the introduction of nonlinear derivatives could fundamentally redesign onchain yield for LPs, vaults, directional trades, and arbitrage.

With that said, options introduce complexity. Greeks interact, hedging is non-trivial, and poorly designed markets can fracture liquidity. Market making options is objectively harder than quoting perps or spot.

However, crypto market makers already price and warehouse exotic contracts through OTC desks for institutional clients. The opportunity is not inventing new math, but productizing convexity in a way that scales on-chain.

Thank you, @flowdesk_co, @KohorstLucas, @owenswill14, @TheiaResearch, @OxBroze, @CabronElBufon, @curiousgurnoor, for your valuable feedback.